Balancing User Experience (UX) and Security in B2B Payments

Balancing the need for a seamless user experience while keeping B2B transactions secure is a tough challenge. In today's fast-changing B2B world, payment solutions must meet customer expectations while dealing with complex security threats.

So, how do you go about this?

What are some practical steps you can take to ensure that your payment solution strikes the balance between an excellent user experience and security?

In this article, you get actionable user-centric strategies to deliver great payment experiences while adhering to compliance and security standards.

The Inherent Tension in B2B Payments

B2B payments inherently involve a higher degree of complexity compared to their consumer-facing counterparts. Beyond the simple transfer of funds, B2B payments are often intertwined with intricate workflows, data-rich invoices, and stringent regulatory requirements.

This multifaceted nature can make the user experience (UX) challenging to optimize, as businesses must navigate a maze of processes and compliance checks.

On one hand, B2B customers demand a frictionless, intuitive payment experience that mirrors the seamless interaction they've grown accustomed to in their personal lives. They expect to be able to initiate, authorize, and reconcile payments with ease, without being bogged down by cumbersome procedures or unintuitive interfaces.

Any friction in the payment journey can lead to frustration, delayed transactions, and even strained supplier relationships.

On the other hand, the heightened risk profile of B2B payments necessitates robust security measures to mitigate the threat of fraud, money laundering, and other nefarious activities. Regulatory bodies like FinCEN, OFAC, and CFPB impose stringent know-your-business (KYB) and anti-money laundering (AML) requirements, which payment providers must diligently adhere to.

Failure to do so can result in steep fines, reputational damage, loss of banking relationships, and more.

Integrating Advanced Security Features Seamlessly

To navigate this delicate equilibrium, payment providers must invest in security technologies that can be woven into the UX tapestry without compromising the overall user experience. One such critical security feature is multifactor authentication (MFA).

MFA adds an extra layer of protection by requiring users to verify their identity through multiple independent credentials, such as a password, biometric scan, or one-time code.

While MFA has long been considered a security best practice, its implementation in B2B payments has historically been plagued by friction, often forcing users to navigate cumbersome authentication processes that disrupt the flow of transactions.

However, the latest advancements in MFA technology have enabled payment providers to integrate these security features seamlessly into the UX.

By leveraging contextual and adaptive authentication methods, businesses can now prompt users for additional verification only when necessary, based on factors like transaction value, location, or device type. This ensures that legitimate users can complete payments quickly and effortlessly, while suspicious activities are flagged and subjected to heightened scrutiny.

Similarly, real-time fraud detection algorithms have become increasingly sophisticated, allowing payment providers to identify and mitigate fraudulent transactions without introducing unnecessary roadblocks.

These advanced analytics engines can analyze a multitude of data points, from transaction patterns to device fingerprints, to detect anomalies and trigger automated risk assessments.

By integrating these capabilities seamlessly into the payment flow, businesses can maintain a frictionless UX while safeguarding their transactions against malicious actors.

Leveraging User-Centric Practices for Clarity and Certainty

Beyond technological solutions, payment providers can also leverage the power of user-centricity to strike the right balance between security and convenience.

Carefully crafted microcopy and contextual clues can play a pivotal role in creating clarity and certainty for B2B customers throughout the payment journey.

For example, when prompting users to provide additional authentication factors, clear and concise instructions can explain the purpose and importance of the extra step, mitigating any confusion or frustration.

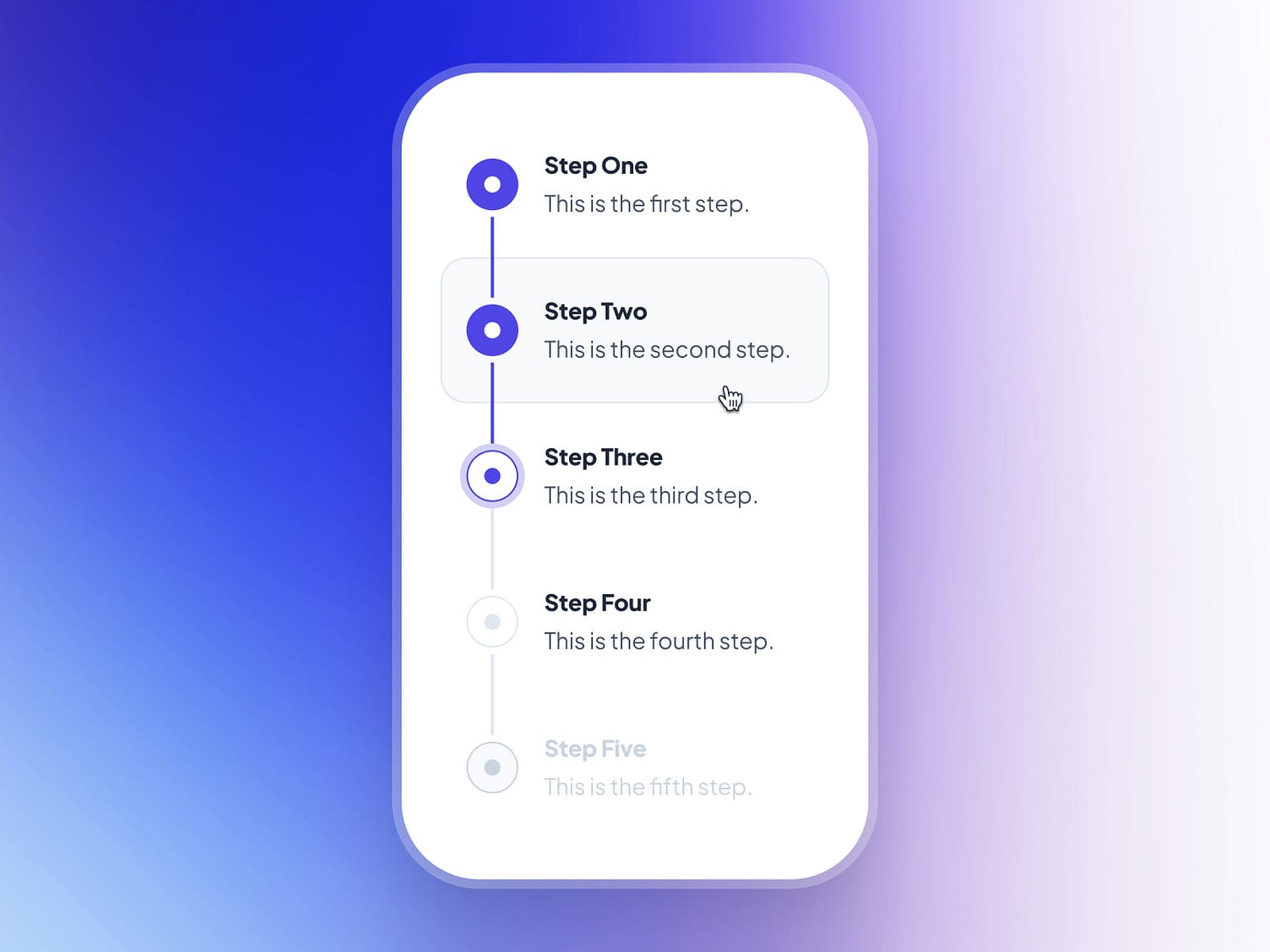

Subtle visual cues, like progress indicators and globally recognized icons, can also reassure users that their sensitive information is being handled with the utmost care.

Similarly, during the reconciliation process, detailed transaction summaries and intuitive categorization can help businesses quickly identify and resolve any discrepancies, creating a greater sense of confidence in the overall payment experience.

By anticipating the needs and pain points of B2B users, payment providers can design interfaces that seamlessly guide them through complex workflows, ultimately enhancing the user's perception of security and control.

WDIR, your partner in B2B Payment UX Excellence

Achieving this delicate balance between frictionless UX and robust security is no easy feat, and it often requires the expertise of specialized partners.

We're trusted by some of the biggest financial institutions in the world as well as innovative fintechs to create seamless, intuitive, and secure payment experiences.