Increase Customer Loyalty With Transparency: A Guide for B2B Payment Solutions

Imagine you’re a small business owner who just completed a sale with an overseas client. The invoice is sent, and the client assures you that payment is on its way, but as the days pass, so does clarity around when it will land in your account.

Your suppliers need payment now, cash flow is tight, and you’re left waiting without any clear visibility into the timeline or final amount—especially with fees and currency fluctuations in play.

This common scenario creates real stress for business owners, impacting everything from operational plans to vendor relationships. For B2B payment providers, transparency in the UX offers a direct solution. When clients can track payments, see exchange rates, and understand fees upfront, they’re no longer navigating in the dark—they’re in control.

For payment providers, offering this transparency is an advantage that builds trust, boosts client loyalty, and sets the service apart from competitors.

Let’s break down three core ways that transparency in UX makes a meaningful difference for business clients—and explore why partnering with a B2B payment UX professional is essential to realizing this potential.

Why Transparency Matters in B2B Payments

Business clients, regardless of size, need confidence in their transactions. For small businesses, timely payments can mean staying operational, while for larger enterprises, efficient payments impact everything from vendor relationships to strategic decision-making.

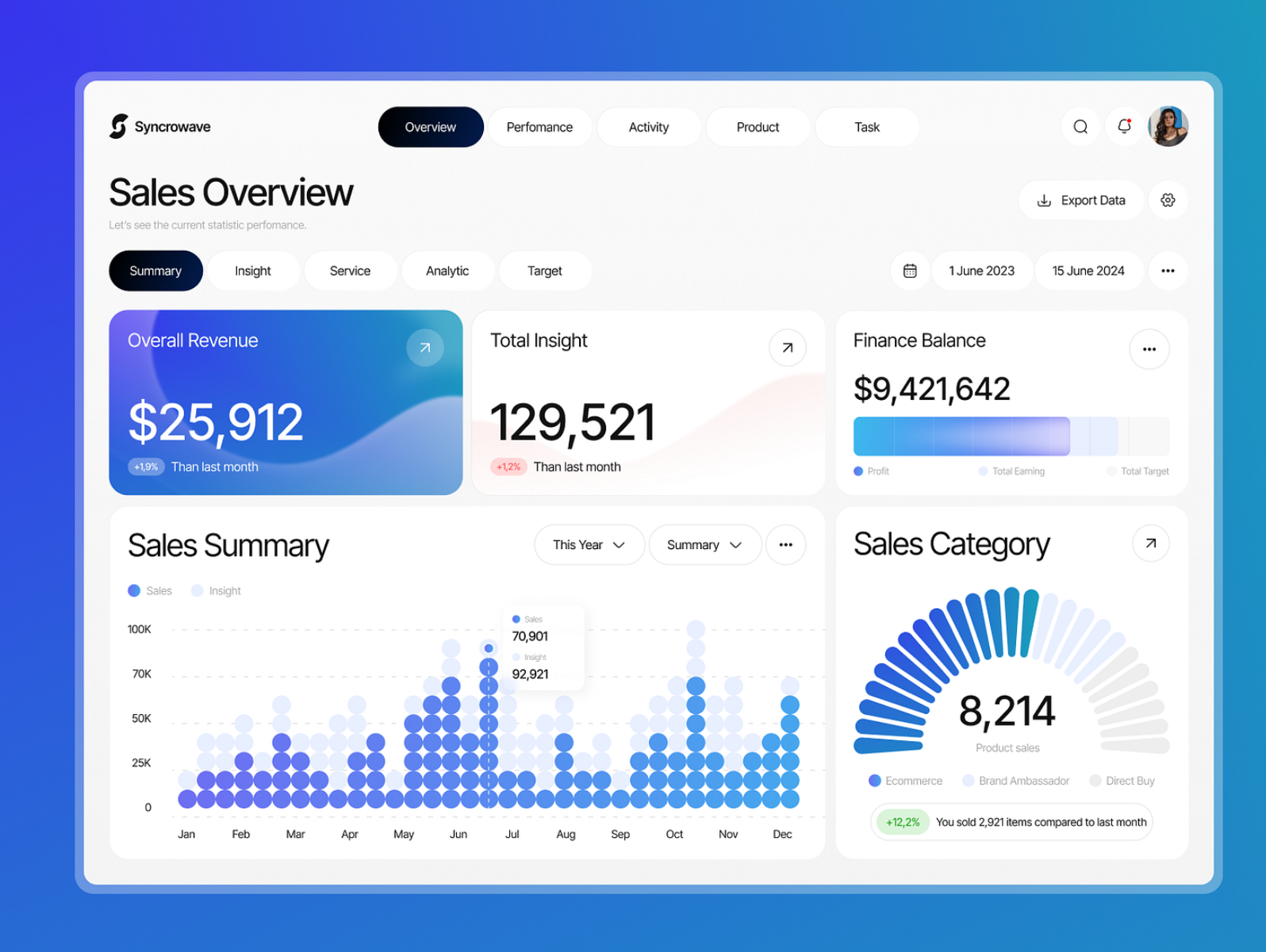

Transparency in payments—through visibility into fees, exchange rates, and timelines—is crucial for planning, cash flow management, and, ultimately, growth.

For payment providers, transparency isn’t just a client perk; it’s a differentiator. When clients can rely on the clarity, consistency, and visibility of their payment process, they are far more likely to stay loyal.

Here’s how a few key features make transparency more than an abstract promise—it’s a competitive advantage that drives business outcomes.

Three Ways UX Builds Transparency and Trust in B2B Payments

1. Real-Time Currency Conversion Rates

Currency fluctuations impact every international transaction, adding an unpredictable layer to cross-border payments. For small business owners, any fluctuation can be costly, and without clear visibility into rates, it’s nearly impossible to make informed financial decisions.

With live conversion rates, clients can lock in the rate they see at the time of payment, removing much of this uncertainty. According to McKinsey, cross-border B2B payments were valued at $125 trillion in 2022, and as businesses increasingly go global, visibility into exchange rates is essential. Small business owners can use live rates to budget and plan, helping them protect their margins and reduce the risk of sudden cost hikes.

B2B payment providers that deliver live rates enable clients to feel confident about the money they’re sending, knowing it’s protected from unnecessary costs due to unknown rate changes.

2. Payment Tracking: Transparency Across Every Step

In B2B transactions, time isn’t just money—it’s trust. Delays, currency exchanges, and intermediary banks can slow payment processes, leaving businesses in the dark about where their money is. Payment tracking fills this visibility gap, providing clients with a clear view of where their funds are and when they can expect delivery.

Let’s look at two practical examples:

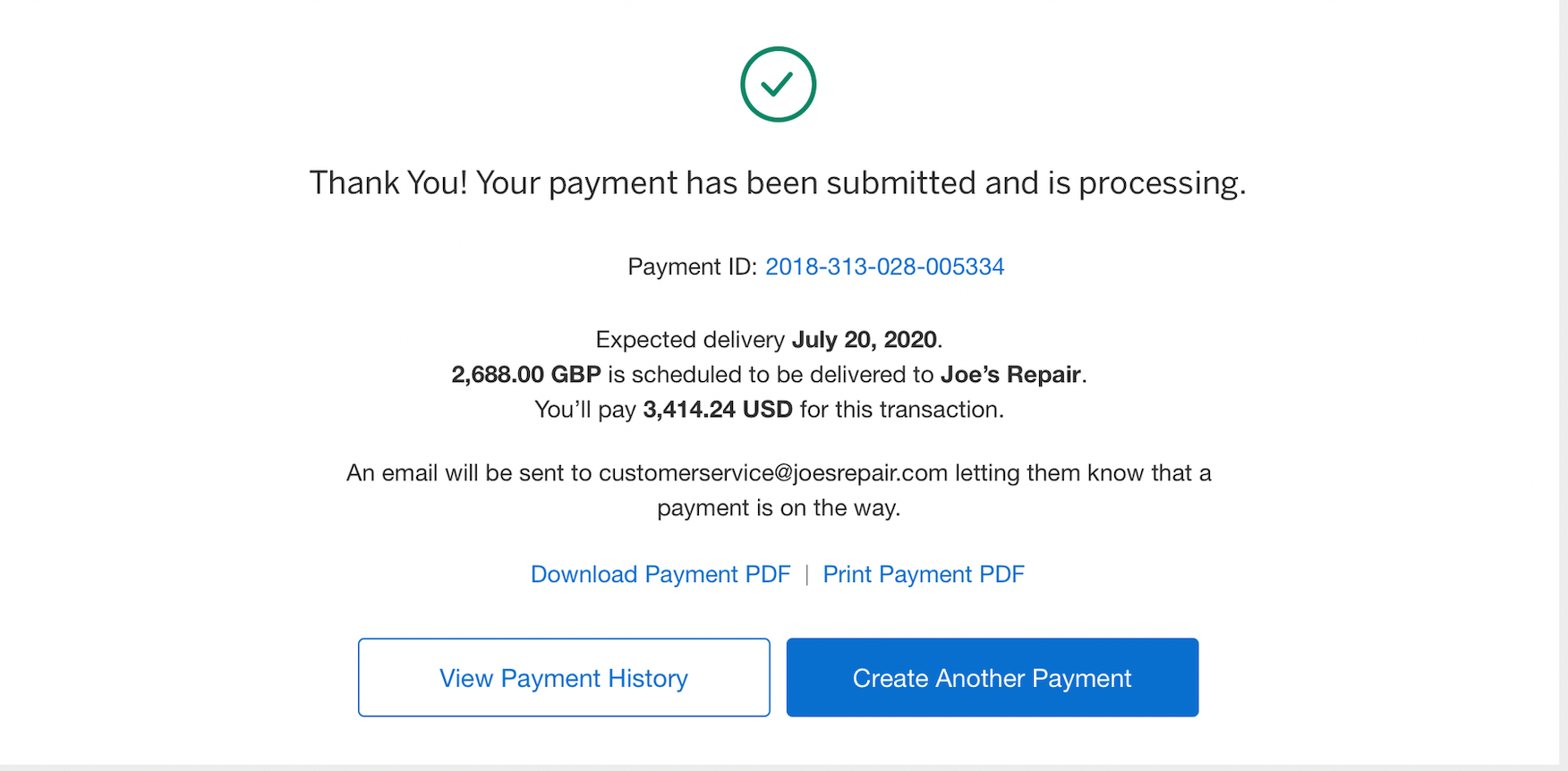

Small Business Owners (SMBs): For a small business owner who needs to pay a supplier overseas, being able to track payments step-by-step isn’t just a matter of curiosity—it’s essential. Knowing precisely when funds will arrive lets them plan around cash flow, make payment commitments with confidence, and ensure operations can run smoothly.

Transparency in payment tracking removes the guesswork, enabling better planning and less financial strain.

CFOs at Mid-Sized Companies: For CFOs managing cash flow on a larger scale, visibility in payments means the difference between accurate cash projections and unexpected budget adjustments.

By knowing exactly when payments will land, a CFO can better coordinate with vendors, optimize working capital, and make accurate projections for their cash flow.

When they have confidence in these forecasts, they can make strategic decisions with less hesitation, knowing their financial data is accurate and up-to-date. Payment providers who offer this kind of visibility aren’t just service vendors—they’re strategic partners, providing CFOs with the data they need to lead effectively.

3. Clear, Upfront Fees: No Surprises

Hidden fees are a top frustration for business clients, who often learn about them only after the transaction completes. For B2B payments, fees can accumulate from intermediary banks, currency exchanges, or added service charges. When fees are clear from the start, clients can plan for these costs, rather than be surprised by them after the fact.

Transparency with fees is more than courtesy—it’s a commitment to client trust. A small business that knows exactly how much a payment will cost can maintain predictable margins and protect cash flow. For mid-sized companies, clear fees allow finance teams to allocate budgets precisely, ensuring cash flow stability and reducing the risk of unplanned expenses.

Transparent, upfront fees signal respect for the client, which builds a foundation of trust—a foundation that sets the provider apart in a competitive industry.

Why Transparency Gives B2B Payment Providers an Edge

In the B2B payments sector, transparency is often the difference between a transactional service and a long-term partnership. Clients who know their providers are upfront and clear about costs, exchange rates, and tracking are far more likely to stay loyal, promote the service to others, and rely on it for larger, more critical transactions.

Transparency isn’t just a support tool—it’s a value proposition. When every step of the payment process visible and predictable, B2B providers create a user experience that clients trust. And in the highly competitive industry that is payments trust is be a decisive competitive edge.

Why You Need a B2B Payment UX Professional

Implementing these transparent UX features requires a deep understanding of B2B payment flows and the challenges businesses face. This is where working with a B2B payment UX professional can make the difference.

In the digital era of payments, UX is a powerful tool for reducing customer acquisition costs (CAC), increasing customer lifetime value (CLV), and driving long-term revenue growth.

A B2B payment UX expert brings a focused perspective to build these transparent, trust-earning features, aligning them directly with business goals and creating real, measurable results.

Key Takeaways for B2B Payment Leaders

- Build Real-Time Rates into Your UX: Offer live currency conversion rates that clients can rely on for budgeting and planning. This feature removes uncertainty around exchange costs, allowing clients to make informed decisions.

- Incorporate Detailed Payment Tracking: Let clients track the progress of payments from initiation to completion. This transparency reduces stress and gives them actionable insights, supporting everything from cash flow management to vendor coordination.

- Make Fees Clear from the Start: Eliminate hidden charges by providing clients with upfront fee details. This transparency not only reduces support inquiries but builds lasting trust, creating loyal clients who value your integrity.

Drive Growth Through Transparency with a B2B Payment UX Expert

Transparency is more than a feature in B2B payments—it’s the key to client loyalty, trust, and growth. Businesses from small enterprises to mid-sized companies need payment solutions they can depend on, where clarity replaces uncertainty, and trust replaces frustration.

For payment providers, prioritizing transparency in UX is far more than a strategy for keeping clients happy; it’s a pathway to competitive advantage, lower costs, and a greater lifetime value.

If you’re ready to make UX a core part of your B2B payment strategy, partner up with WDIR to bring greater transparency into every step of the client experience.